Portfolio management is the art and science of selecting and overseeing a group of investments that meet the long-term financial objectives and risk tolerance of a client, a company, or an institution.

Investopedia

As of now, I currently manage several portfolios. And it’s beneficial to have different types of brokerage accounts: Cash-Taxable Account, Margin Account, IRA, Rother IRA, Joint Accounts, etc… Each has its own unique benefits and especially when it comes to taxes, which is a very important part of investing yet is very much neglected.

But Portfolio Management gets into the whole strategy of planning a portfolio, determining what will be your focus or emphasis, and what goals do you have, whether its for future growth, to develop dividend income, and to become a millionaire. Whatever goals you have should be written down somewhere, just like a small business developing a business plan.

Determining Investments

The portfolio manager must determine what types of investments will be utilized in a portfolio. The typical investment vehicles include stocks (equities), bonds, REITs, ETFs, index funds, mutual funds, money market and cash. Other assets that might fall into a portfolio would be silver, gold, other precious metals, forex, options, futures, commodities, and so on.

I go by a very simple strategy of buying and selling individual stocks. I might own the occasional REIT or ETF, but stocks (equities) are my number one focus.

Why?

Simplicity.

If you focus on one thing you get good at it, pure and simple. You have a more focused strategy, and your intent is one of purity. You get good at one thing and you become an expert at it. And it’s like the feedback that cycles through a PA system, it gets louder and louder… the one sound gets recycled over and over through the PA system and you get that loud noise. I guess that’s one analogy for investing in individual stocks.

Diversification is Essential

I see too many newbie trader/investors putting everything they’ve got on one stock. While this will increase your chances of striking it rich if the stock surges upward, if it goes the other way? Chances are you’ll lose everything, and I just read about someone who lost $70,000 of his life savings trying to trade aggressively on Robinhood.

How do I know he was trading aggressively?

Well, he lost all his money, therefore… no sound strategy, no conservative and safer investments… he was going for broke and that was the result.

Diversification means: Don’t put all your eggs in one basket.

No matter how little you have to start out. It’s wiser to try and buy a handful of stocks in different sectors: tech, pharma, energy, medical, etc.

One sector could go down overall. So, at least you’ll have other sectors represented that do better.

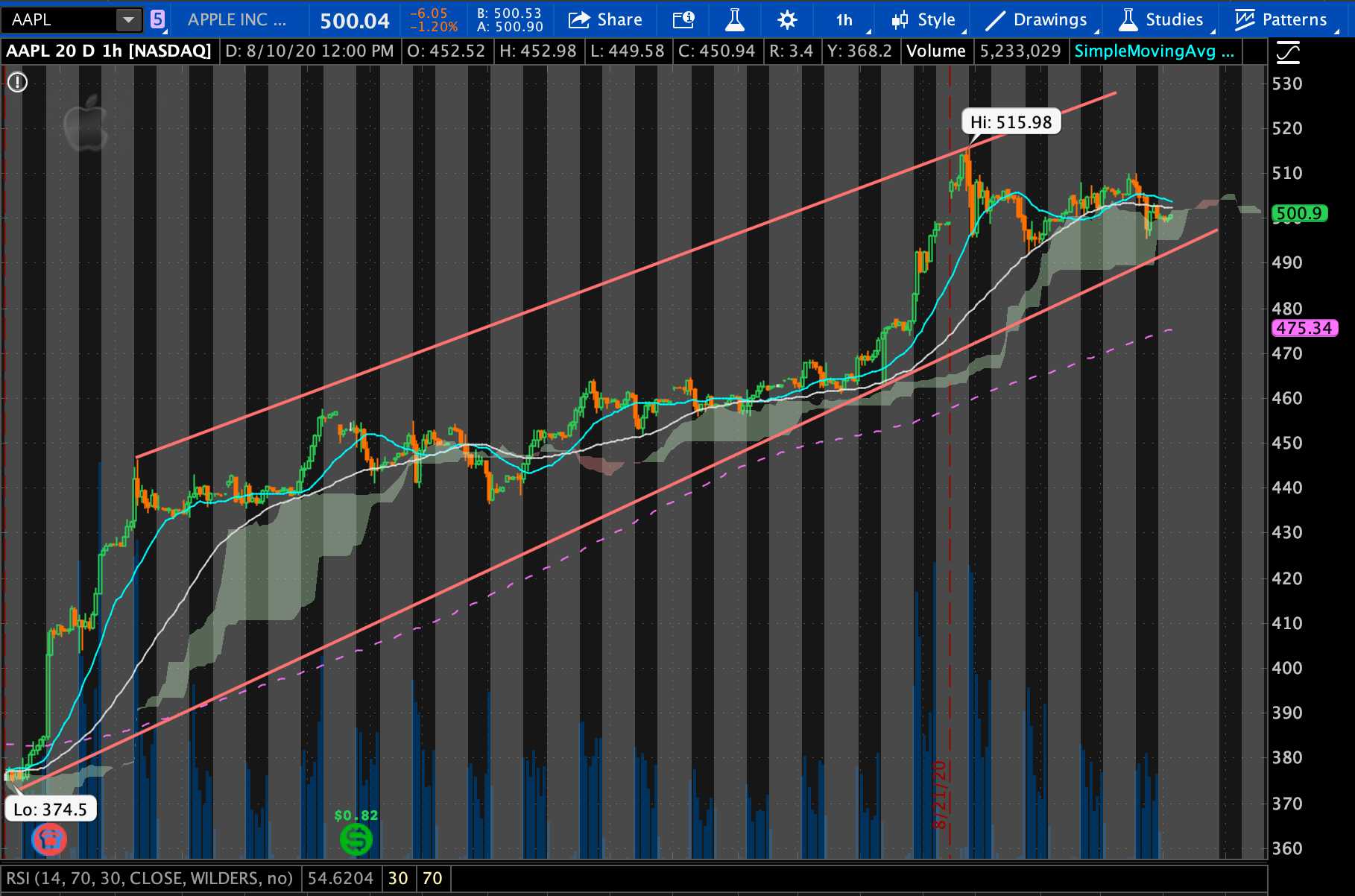

I try to go with 4-5 great companies, that have been highly successful for decades. Examples: Disney (DIS), GOOG (alphabet), Apple (AAPL), Microsoft (MSFT), eBay (EBAY), just to name a few.

Study Current Trends

Studying current trends can be beneficial in the short term, and that’s another thing to think about. Invest in stocks with varying interests and popular trends. While these trends might not last decades, since technology and business models often change with the times, it still is beneficial to invest into the popular trends that are happening now, as well as what might become the new normal in the future, like electric cars.

A perfect example is the Global Pandemic. I’ve invested in companies that have taken advantage of the pandemic and because many are in lockdown or quarantine mode until the Covid-19 is eradicated.

Companies like Amazon (AMZN), Teladoc Health (TDOC) Zoom (ZM) and PayPal (PYPL) have all benefitted from the global pandemic, since many are staying home.

For instance, Amazon (AMZN) owns Whole Foods and Amazon Fresh. Many are having their groceries delivered to their house for extra safety. And Zoom (ZM) has made it much more convenient to stay in touch with family and friends during the global pandemic.

These are trends that every investor should take advantage of, and falls in line with diversifying your portfolio to help make it safer and more successful.

Disclaimer: The stock market is prone to extreme fluctuations and volatility. Trade at your own risk.

Related Posts