When it comes to stock trading, one of my current strategies is to gravitate toward a scenario where I swing trade a stock, with the option to hold long.

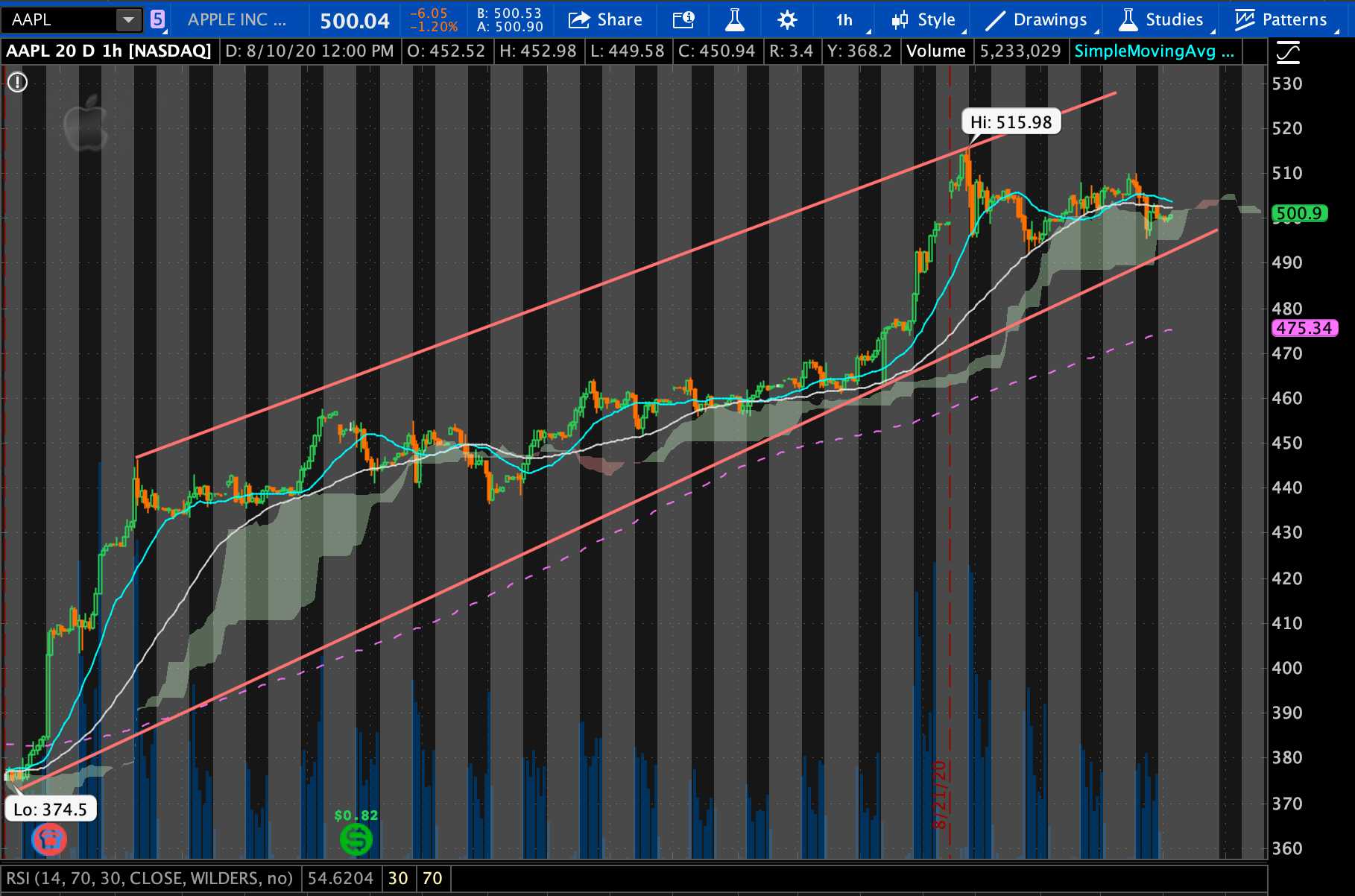

In an ideal scenario, a top performing stock will show a strong uptrending 1 year chart. There will be bumps along the way, and these are good areas to buy in, and then take advantage of the uptrend by hold on for a few days to a few weeks, then sell for a nice profit.

And, if the stock is doing quite well, and the company shows strong fundamentals, then I have the option to hold long, and this might include taking profits off the top but still keeping the position as it gains and increases its percentage gain.

Of course, there is the scenario that the stock suddenly plummets and you are in the red. If the stock has great fundamentals, I hold on because eventually, that negative side will iron itself out and then we’re back in the green.

Of course, if I were day or swing trading a stock that has lots of volatility for quick profits, but it goes red, I’ll hold on for as long as I can, but there comes a point in time where it’s best to sell for a loss, or hold until it gets better, then sell for a smaller loss. But for the most time, I try to buy and sell stocks that have a great track record and solid fundamentals.

The advantages of trading this way? Swing trade to optional long hold?

1. You buy solid performing companies that you can hold long.

2. You have the option to swing trade the stock to get out with a nice profit.

3. You can take some profits off the top and still hold the position long.

Related Posts